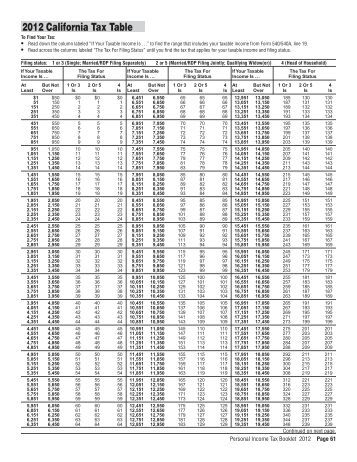

View California State Tax 2Ez Table 2016 Background. California has four state payroll taxes which are administered by the employment development they are unemployment insurance (ui) and employment training tax (ett), which are employer contributions, and state disability insurance. Tax table for filing status single on form 540 2ez.

If amending forms 540 2ez, 540, or 540a, see the instructions for lines 1 through 6 • revised california tax return including all forms and schedules.

This is for my 2008 not 2009 tax return.i filled out the entire 540a form and i ended up with a $450 refund. The california state tax tables below are a snapshot of the tax rates and thresholds in california, they are not an exhaustive list of all tax laws, rates and legislation. If amending forms 540 2ez, 540, or 540a, see the instructions for lines 1 through 6 • revised california tax return including all forms and schedules. Other tax tables may apply if you made payments to shearers, workers in the horticultural industry, performing artists and those engaged on a daily or if you employ individuals under a working holiday makers visa, you must use the tax table for working holiday makers for all payments made to them.